Stay informed with free updates

Simply sign up to the US companies myFT Digest — delivered directly to your inbox.

The US drugs regulator is preparing to accelerate approvals for cheaper generic versions of complex biological medicines, threatening to jeopardise revenue for some of the industry’s most profitable products.

The US Food and Drug Administration is expected to take measures on Wednesday that include reducing the number of certain human clinical studies and cutting costs of medicines engineered with living cells.

The changes would come despite fierce lobbying by the industry’s top representatives in Washington, who have spent millions of dollars to derail less-expensive biological options.

The FDA’s move to speed up approvals builds on US President Donald Trump’s recent deals with companies to lower prices and heaps more pressure on the industry’s profits.

US drug companies Eli Lilly, Pfizer, Merck and Bristol Myers Squibb have lagged the S&P 500 index this year in part because of uncertainty about Trump’s pricing scrutiny. The companies have warned shareholders about the threats posed by generic biological competition, regulatory filings show.

Biological drugs, which use living organisms such as cells or tissue, have been more difficult for generic drug producers to replicate in “biosimilar” versions, compared with conventional medicines that are comprised of chemicals. As a result, biological drugs carry steep price tags that have sparked public outcry.

These medicines make up just 5 per cent of prescriptions in the US, but accounted for more than half of total drug spending in 2024, according to the FDA.

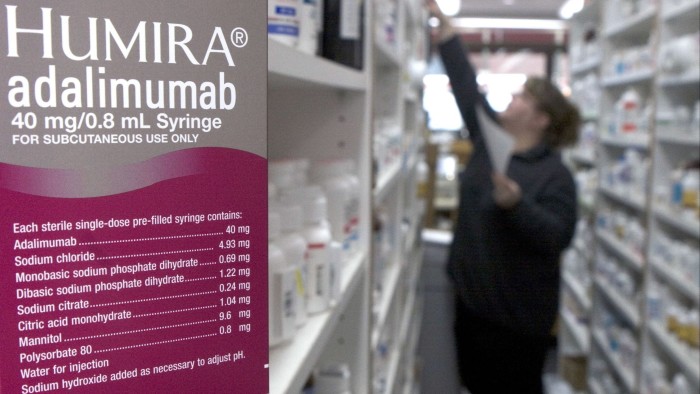

Biosimilars were central to litigation involving AbbVie’s anti-inflammation medication Humira, which was the world’s bestselling drug from 2015 to 2019. AbbVie had charged $77,000 a year for the drug.

In 2019, the city of Baltimore sued AbbVie and alleged that the company’s patent strategy violated antitrust law and that people unnecessarily paid millions of dollars for Humira. The city lost the case in 2022.

Industry lobbying group PhRMA has fought legislation that would have cut red tape for biosimilar drugs, arguing the changes were a “giant giveaway” to companies that had “manipulated the biosimilar market for their own profits”.

“Rather than boosting competition and reducing drug costs, it will only create more opportunities for greedy middlemen to increase their profits and decrease treatment options for patients,” PhRMA said in September 2024. The legislation failed to pass last year.

Earlier this month, Bristol Myers Squibb hired Jeff Miller, a Washington lobbyist known for his connections with the Trump family, to work on biosimilars.

The cheaper versions “could negatively impact our volumes and prices”, New Jersey-based BMS said in its annual regulatory filing this year.

Generics companies Teva, Dr Reddy’s and Sandoz have lobbied in favour of biosimilar reforms.

Europe has taken a more liberal approach to allowing the drugs and offering lower prices.