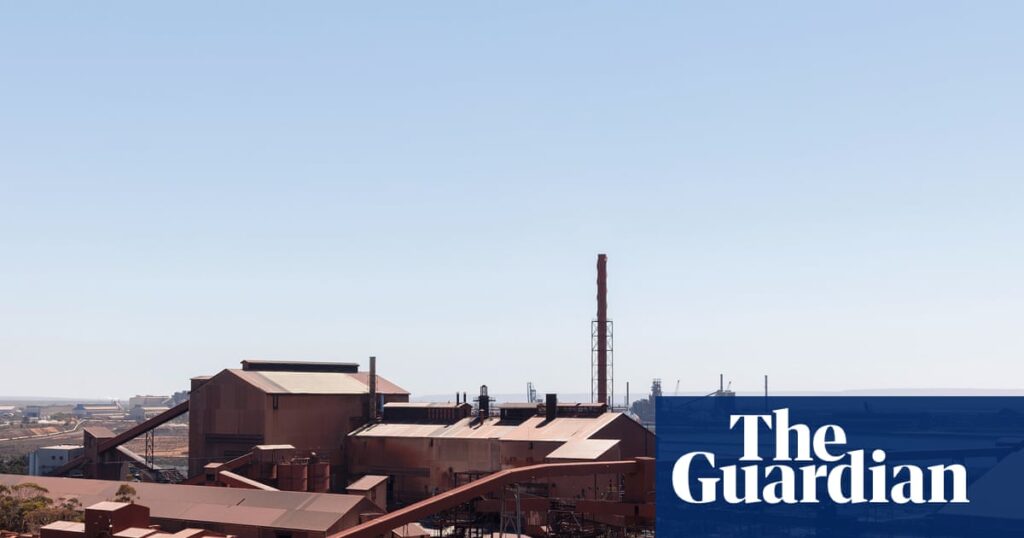

Australia’s largest steelmaker, BlueScope, is part of an international consortium considering a takeover of the embattled Whyalla steelworks, which was stripped from the control of British industrialist Sanjeev Gupta earlier this year.

A consortium consisting of the Australian steelmaker, Japan’s Nippon Steel, Indian company JSW Steel and South Korean manufacturer POSCO, has submitted a non-binding expression of interest in the South Australian steelworks, BlueScope told shareholders on Monday.

“Any decision to make an offer to acquire and develop expanded operations at Whyalla would be subject to due diligence and the consortium members’ return on investment hurdles,” BlueScope said in a statement.

Sign up: AU Breaking News email

“The consortium has identified Whyalla as a prospective location for future production of lower emissions iron in Australia for both domestic and export markets, with the potential to play an important role in the decarbonisation of the global steelmaking industry.”

POSCO led a 2017 bid to take over Whyalla, but was outbid by Gupta.

BlueScope, which operates the Port Kembla steelworks south of Sydney, said there was no obligation to turn the consortium’s expression of interest into a formal bid.

Whyalla is one of only two major integrated steel projects in Australia and the only local manufacturer of rail.

It is seen as a highly sensitive project, politically, given the steelworks is a major employer in a regional city creating a product not made anywhere else in Australia.

Earlier in 2025, the steelworks received a $2.4bn state and federal government bailout package to help keep it afloat and save jobs, after the South Australian government removed control from Gupta’s GFG Alliance amid mounting debts.

GFG had pledged to decarbonise the plant, which included a plan to use renewable energy-produced hydrogen in the manufacturing process to make sought-after green steel.

But the promised investment never arrived. When administrators were appointed in February, the steelworks was found to have racked up more than $1.3bn in debts, including unpaid employee entitlements.

A GFG spokesperson said at the time the operation faced “significant operational and financial challenges” due to external and internal factors.

after newsletter promotion

Many of the financial problems facing Gupta’s global steel empire are linked to the 2021 collapse of its primary financier Greensill Capital, an event that rattled his global steelmaking businesses, which include operations in the UK, continental Europe and the US.

The South Australian premier, Peter Malinauskas, said on Monday that more than 15 national and international parties had passed the final expression-of-interest phase in a positive sign for the steelmaker’s transition to new ownership.

The sales adviser will now solicit indicative bids from shortlisted parties that expressed interest, with no preferred bidder at this stage.

“The state government’s objective has been to transition the ownership of the steelworks to a new credible owner who can invest in Whyalla’s future,” Malinauskas said in a statement.

“This strong interest is a positive sign for the future of the Whyalla steelworks and for the future of sovereign steelmaking capability in Australia.”