The ghost of Pat Gelsinger hung heavily over Intel’s fab plant in Arizona earlier this month as journalists from around the world gathered for Intel’s annual Tech Tour, and I can tell you now that he was laughing his ass off in triumph.

Gelsinger, Intel’s former CEO, was unceremoniously jettisoned by Intel’s board late last year, and while he technically resigned, it was widely reported that if he hadn’t, he’d have been fired. During his tenure, which some in the business world called “disastrous“, Gelsinger bet heavily on chip manufacturing through Intel Foundry to the tune of tens of billions of dollars.

These investments, in turn, eventually produced headline-making billions of dollars in losses on Intel’s balance sheet, as equipment expenses far outpaced revenue from chip sales. Add to that, Intel “missed” the AI revolution that sent Nvidia soaring into the multi-trillion dollar club on Wall Street by not having an AI chip of its own to compete with Nvidia.

By betting on manufacturing, Gelsinger lost his job, and the proverbial sharks from Wall Street to Reddit started circling Intel as talk swirled of a breakup of the company to save it from Gelsinger’s foolhardy emphasis on a manufacturing foundry to compete with TSMC.

Having seen Intel’s latest chip fabrication plant first-hand, however, I can A) absolutely see how Gelsinger blew through tens of billions of dollars; B) say without hesitation that the first product to come off the line thanks to that investment, Intel Panther Lake, is going to be a huge win for Intel; and C) hope that Gelsinger enjoys seeing all of his critics proven phenomenally wrong.

First, let’s talk Panther Lake

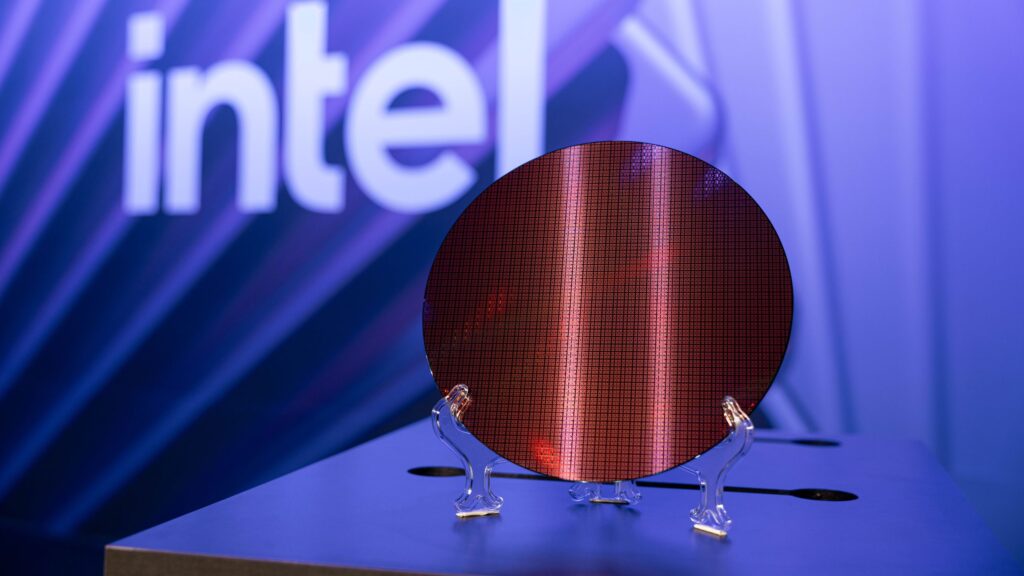

The first consumer chips to come off the line at Fab 52 in Arizona, where Intel’s new 18A fabrication node is housed, will be the new Intel Core Ultra series 3 chips, formerly codenamed Panther Lake.

These chips are designed for laptops as well as lighter-duty AIO and small form factor PCs, just as Intel Lunar Lake was before it. What’s different here, though, is that there is a lot of new technology backing up these chips that no one else is using, such as backside power delivery and an off-die interconnected GPU that allows for greater GPU core scaling.

The former allows power to be delivered from a layer below the transistors, granting a lot more design freedom than you get with the frontside power delivery used by TSMC and Samsung, and thus Intel’s competitors. It’s a small change, but it allows you to scale your chip in ways that weren’t possible before using interconnects, and has the potential to improve power efficiency and signal integrity overall.

For the GPU, it will also feature a new Intel Xe3 GPU architecture that supports multi-frame generation, which, when paired with Intel XeSS upscaling, has the potential to turn pretty much any thin-and-light ultrabook into a budget gaming laptop.

I got to test out a Panther Lake-powered laptop with Painkiller 3 for a spell, and even without frame generation, the game was easily clearing a 50 fps minimum at 1080p with XeSS set to Quality on the highest graphics settings possible. Granted, it’s one game, but it is a fast-paced shooter, and there was zero perceived latency while I played with MFG, and the game was clearing about 140 fps on average.

There isn’t a thin and light laptop on the market that can do this right now—especially not the MacBook Air, the laptop that Panther Lake is specifically gunning for—and most games on the market aren’t fast-paced first-person shooters, so MFG will be a massive sell for these devices.

As for non-gaming performance, I haven’t benchmarked any of these systems myself, so I can’t give you scores, but even Intel Lunar Lake chips are practically even in real-world use against a MacBook Air with M4, say whatever you want about the various design differences between the two ecosystems.

Microsoft Word opens pretty much the same on both systems, encoding video off either CPU takes about the same amount of time, and while the MacBook Air general gets better battery life, Lunar Lake chips have closed that gap enough that you really need to have a very specific reason to keep your laptop unplugged for 24 hours straight on a regular basis for the difference to matter.

There’s not going to be enough here to get a Mac user to switch to a Windows laptop, but no chip is going to get an Apple fan to switch. What it does though is make it so Windows users don’t have a reason to switch to a Mac, or, probably more importantly, a Qualcomm Snapdragon X-powered Windows laptop.,

With all that said, though, I did get to see internal performance data from Intel engineers that puts Panther Lake above Intel Arrow Lake performance-wise, while keeping the energy efficiency of Lunar Lake, which is a hell of a combo if it holds up. I won’t know until I test these chips myself after CES 2026, obviously, but from what I saw, Intel shouldn’t be too far off from these performance claims.

And while Apple may yet retain the title for best single-core performance on Geekbench among the thin and lights, that gap will at least get a lot smaller even with the Apple M5 chip, which will still be using TSMC’s 3nm node versus Intel’s 1.8nm, since TSMC has struggled to get its N2 node up and running on schedule.

Intel 18A: Gelsinger’s gamble might become Intel’s windfall

Much of Intel’s future is going to depend on the success of Intel Foundry’s 18A processor fabrication node and the products produced on this node. Panther Lake, Intel Nova Lake (Intel’s next-gen desktop processors), and Intel Clearwater Forest (Intel’s new Xeon 6+ datacenter chips), are all 18A fabbed, but ultimately Intel’s success isn’t depending on whether those chips outsell the competition, but whether those chips convince AMD, Nvidia, Qualcomm, and yes, even Apple, to manufacture their chips on Intel’s nodes rather than TSMC’s or Samsung’s.

The bet that Gelsinger made, that Intel could manufacture chips as advanced as TSMC’s in the US, cost him his job. To materially catch up with TSMC in terms of process technology was never going to be cheap, and Wall Street would much rather Intel had simply outsourced its chipmaking to TSMC entirely rather than invest tens of billions to build up the chip plants to do it itself.

Gelsinger made those investments, though, and touring Intel’s Fab 52 in Arizona was revelatory. I wasn’t allowed to take pictures inside the plant itself, unfortunately, but the plant was already humming with production. Customers are already spending money to fab their chips on Intel 18A, and security around who those customers are is understandably very tight, as is the suppliers Intel uses, what machinery is being used, etc.

I’m sure a lot of corporate spies or even foreign intelligence agents would have paid just about anything to get the tour I did, and I understand why. Intel 18A might well be the most advanced process technology ever devised by humans, with an Intel product manager telling me that the tech involved in etching the image of the processors in question is the equivalent of a person standing on the Moon with a laser pointer and hitting the tip of someone’s outstretched finger at sea level on Earth.. The machine that does this, meanwhile, is absolutely enormous, and it was running while I was there.

By now, everyone should know the aphorism that the key to making money during a gold rush is to be the one selling the shovels. It’s why Nvidia went from being a successful but relatively mid-sized maker of graphics cards that only really mattered to gamers to a world-striding corporate behemoth with a valuation in the $4T range almost overnight.

They don’t make the AI products like ChatGPT; they make the GPUs that power the AI products., and so they’re getting a cut of every AI product hitting the market.

But even then, Nvidia doesn’t actually make its own chips. It has to outsource the actual fabrication of its GPUs to a chip foundry and competition for production time on the most advanced process nodes has been fierce in recent years, and it’s only getting more intense as AI demand grows.

From what I saw with Intel 18A, though, chips are already rolling off the lines, and there seems to be more than enough capacity to start soaking up already sky-high demand as well as room in the facility to expand production even further if demand warrants it. And given that all these chips are manufactured in the US, they won’t be subject to the kinds of tariffs that could snap back on TSMC’s or Samsung’s chips at a moment’s notice, potentially driving up costs for the end products they power.

Ultimately, Intel Foundry’s 18A process node looks like a huge win for Intel, even if nothing else changes, and if things do change, Intel’s position as a US-based fab might give it decisive advantages over its overseas rivals.

As for the AI bubble we’re currently in, it will pop one day, for sure, and a lot of that AI demand will dry up. But the Dot Com bubble still produced winners like Amazon and Cisco, because those companies produced actual products and provided actual, useful services.

So advanced semiconductors aren’t going to be in less demand after the AI bubble pops, there are plenty of customers from government agencies to big business who will need the fastest chips possible, and so the current AI bubble is likely to be the on-ramp to sustainability that Intel Foundry needs right now, but it’s success isn’t tied to that bubble the way OpenAI’s is.

Meanwhile, none of this is even factoring in the possibility that Intel might actually have created the most advanced process node technology in the world, while also locking in this position for at least half a decade, if not longer, something that is going to draw in business on its own regardless of other factors.

All of this is real money, big money, and Gelsinger’s bet on Foundry looks like it’s about to pay massive dividends for Intel in the years ahead.

Will Apple, AMD, and Nvidia take a chance on Intel 18A?

Now the only remaining question is whether Apple, AMD, and Nvidia will get on board and use Intel Foundry’s services for their chips, and frankly, it’s not even really a question at this point. Of course they will.

They may not like it, but there is only so much advanced process node capacity in the world, and the only other two foundries capable of sub-3nm production are TSMC and Samsung.

TSMC’s most advanced 2nm fab, which will likely hit production in the second half of 2026, is on the island of Taiwan, and TSMC has said it plans to bring it to the US at some point in 2026 or later, but that’s very questionable at this point. So if Intel’s chips are in fact more advanced than a TSMC node that hasn’t even hit production yet, even if TSMC builds 2nm in the US, it will still lag behind the chips Intel is making right now.

Taiwan, meanwhile, may or may not be a territory of mainland China, depending on who you ask in the US government. China, on the other hand, will absolutely tell you that Taiwan is its territory, and the Chinese government has not ruled out using military action to bring Taiwan under its direct control. The possibility of a sudden disruption in the chip supply coming out of Taiwan isn’t a fantastical idea, especially given how hostile the US has been to China’s technology sector in recent years, and the promise of TSMC producing chips in the US to meet demand is unlikely to develop the way Intel’s critics hope.

Meanwhile, the other major foundry, Samsung, is in South Korea, a nation still technically at war with North Korea, a nuclear-armed country led by an authoritarian ruling family that many would characterize as diplomatically unstable and which repeatedly threatens its neighbor to the south with a resumption of full-scale war. If you’re looking for a stable supplier of advanced semiconductors in an uncertain world, well, putting all your chips on Samsung if you can’t rely on TSMC Taiwan doesn’t look like a great bet.

The chance of armed conflict breaking out in either of these places doesn’t look likely, but these things never look likely until they happen, and the risk for tech companies relying exclusively on TSMC or Samsung might turn existential overnight. Intel 18A carries none of that potential risk, and if Panther Lake, Nova Lake, and Clearwater Forest prove that Intel 18A is as good as Intel claims, it would be business malpractice not to hedge that risk by contracting with Intel as well.

What’s more, demand for these chips is only going up, and both Samsung and TSMC’s plants can only produce so many chip wafers in a given day. There is already a supply bottleneck that can’t meet demand, so that overflow is going to have to move elsewhere, and Intel 18A is the logical second or even third choice if you really prefer TSMC and/or Samsung.

Of course, it’ll be a bitter pill for AMD and especially Apple to swallow, given the intensity of their relationships and rivalry with Intel over the years. But with the uncertainty of tariffs and supply being what they are, they will both eventually contract with Intel for 18A and Intel’s next-gen 14A when that comes online later in the decade.

Kicking and screaming, absolutely, but in the end, they won’t have a choice in the matter, and Intel will be getting paid for every one of those chips, no matter whose branding they carry when they hit the market.

I hope Pat Gelsinger is enjoying himself

It’s not very often I sing the praises of wealthy industrialists and business leaders like Pat Gelsinger, but I do make an exception in this case.

Conventional wisdom nowadays would have told Gelsinger to spend those many billions of dollars he invested in Intel Foundry into something like stock buybacks or some other paper-moving financial maneuver to prop up Intel’s stock price to make Wall Street investors happy.

This would have been a terrible move for Intel, though, especially as it is losing more and more market share to more ‘nimble’ rivals who outsourced the actual making of their chips to TSMC. The conventional wisdom in this case was a recipe for Intel’s gradual decline into irrelevance while stripping the company bare to sell the copper wire out of its metaphorical (and possibly literal) walls.

It wasn’t an easy call for a CEO to turn around and invest an ungodly sum of money in upfront costs (about $30B+ in total) to build out a world-class fab plant with Intel 18A, knowing that the return on that investment would only begin after several years. Gelsinger did just that, though, and unfortunately, he got forced out of the company just before the harvest was due.

I can’t tell you how well the new Intel Core Ultra series 3 chips will end up selling in the end, but I can say that from what I’ve seen, these are damn good chips. Better than an Apple M5? The jury’s still out, at least until we get both of them in hand to try out ourselves. What matters, though, is that regardless of whether they’re the best, second, or third-best chips on the market, they are going to be very competitive, and they were built in-house, and that same process technology is up for sale for anyone to use.

The same process technology behind the Intel Core Ultra series 3 might end up making the Apple M6 a substantially better chip than what we’re set to get from the M5, which is reportedly a 3nm TSMC chip, or even powering the Nvidia GeForce RTX 60-series cards (if those ever become a thing) or Nvidia Rubin datacenter AI chips. Whether Intel’s chips outsell everyone else isn’t really the point. If you’re making everyone else’s chips and getting a cut of every sale, does it matter that they’re outselling your own in-house product? You’re still making bank regardless.

As far back as March 2025, Nvidia was reportedly running several test samples on Intel 18A to gauge its performance, only for Nvidia to invest $5B into Intel just last month. Neither Nvidia nor Intel would confirm or deny Nvidia planning to use the new node for future products, but the writing is kind of on the wall here. Hell, even AMD is in talks with Intel about fabbing their chips on 18A. What a world.

For all this, Intel has former CEO Gelsinger to thank. Whether they do or not doesn’t really matter, but I hope other industry leaders take some inspiration from what Intel is set to do and realize that investing in innovation is worth the cost, no matter how much it spooks the suits in accounting.

I also hope that Gelsinger is sitting on a beach somewhere with a funky cocktail with an umbrella, enjoying the fact that everyone is going to have to admit that he was right all along.