Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Sales of Eli Lilly’s weight-loss drugs more than doubled as they reached new global markets in the most recent quarter, underscoring the value of the blockbuster medicines for the pharmaceutical industry.

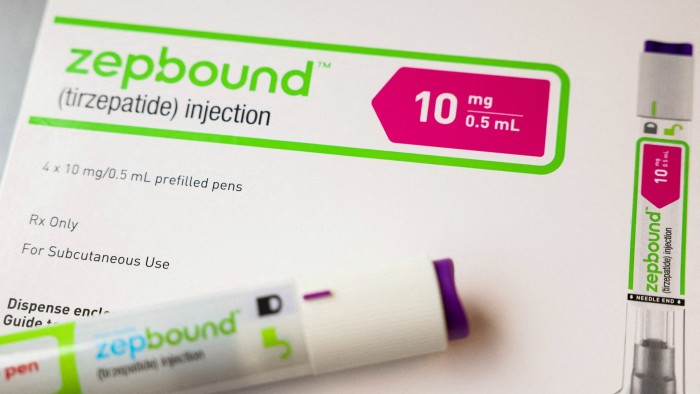

For the three months ending September 30, Lilly reported on Thursday that sales of its weight-loss drugs Mounjaro and Zepbound jumped 109 per cent and 185 per cent, respectively, from the same period a year ago.

Demand for the drugs rocketed outside the US, Lilly said, often in new markets where they were not previously offered. For Mounjaro, which treats diabetes, sales abroad more than tripled, the company reported. Zepbound, which treats obesity, was first approved in Europe in April 2024 and did not have foreign sales in the third quarter last year.

The two drugs generated a combined $10.1bn in the quarter. Lilly said stronger demand globally for weight-loss drugs offset lower prices.

The significance of weight-loss drugs for the pharmaceutical sector was further highlighted by an unexpected battle between rivals Pfizer and Novo Nordisk over a small biotech that is making an obesity drug.

Novo on Thursday bid $9bn for Metsera, after Pfizer in September agreed to buy the company for $7.3bn. Pfizer, which does not have a weight-loss drug, blasted Novo’s offer as an attempt “to circumvent antitrust laws” and threatened legal action.

Lilly’s shares closed 3.8 per cent higher on Thursday. Novo’s shares dropped 3.6 per cent and Pfizer’s were unchanged.

Among investors, “there was some obesity-investment fatigue earlier in the year”, said Evan Seigerman, head of healthcare research at BMO. But now, after Lilly’s results and the Novo-Pfizer battle, “investors are on board”.

Lilly also increased its 2025 earnings guidance to $21.80 to $22.50 a share. The company had previously predicted a range of $20.85 to $22.10 a share.

On Wednesday, Lilly said Zepbound would be sold directly in Walmart pharmacies for $349 to $499 a month. Next year, Lilly is expected to start selling a weight-loss pill. The company expects to submit the drug, Orforglipron, to regulators in the months ahead.

Still, Lilly faces headwinds from President Donald Trump. Pfizer is the only US drugmaker to announce a pricing deal with Trump. Shares of Lilly and other drugmakers jumped in late September after Pfizer’s deal with the president. But a month later Lilly still has not reached an agreement.

Separately on Thursday, drugmaker Merck said its net income increased more than 80 per cent year on year to $5.8bn in the last quarter, as its top-selling cancer drug hit record sales. Revenue rose 4 per cent to $17.3bn.

Sales of Merck’s blockbuster drug Keytruda rose 10 per cent to $8.1bn in the three months to the end of September, up from $7.4bn from the same period a year ago.

Merck also edged up its full-year guidance for adjusted earnings, predicting $8.93 to $8.98 a share, from its previous forecast of $8.87 to $8.97 a share. Wall Street expects $8.91 a share.